Research Note: The 12-Layer AI Stack and Emerging Techno-Societies

Recommended soundtrack: Crossroads, Robert Johnson

The 12-Layer AI Stack and Emerging Techno-Societies

—————-

The 12-layer artificial intelligence (AI) stack provides a framework for the development and deployment of advanced AI systems, but it also hints at the potential emergence of techno-societies centered around technology behemoths driving AI innovation.

Defining the Layers:

The 12-Layer AI Stack and Emerging Techno-Societies

The 12-layer artificial intelligence (AI) stack provides a comprehensive framework for understanding the various components and capabilities required for the development and deployment of advanced AI systems. However, this stack goes beyond just the technical aspects, as it also sheds light on the potential emergence of societies centered around the technology behemoths driving AI innovation.

Defining the Layers:

1) Base Load Power Supply:

Ensuring access to reliable and cost-effective energy sources to power the massive computational demands of AI systems.

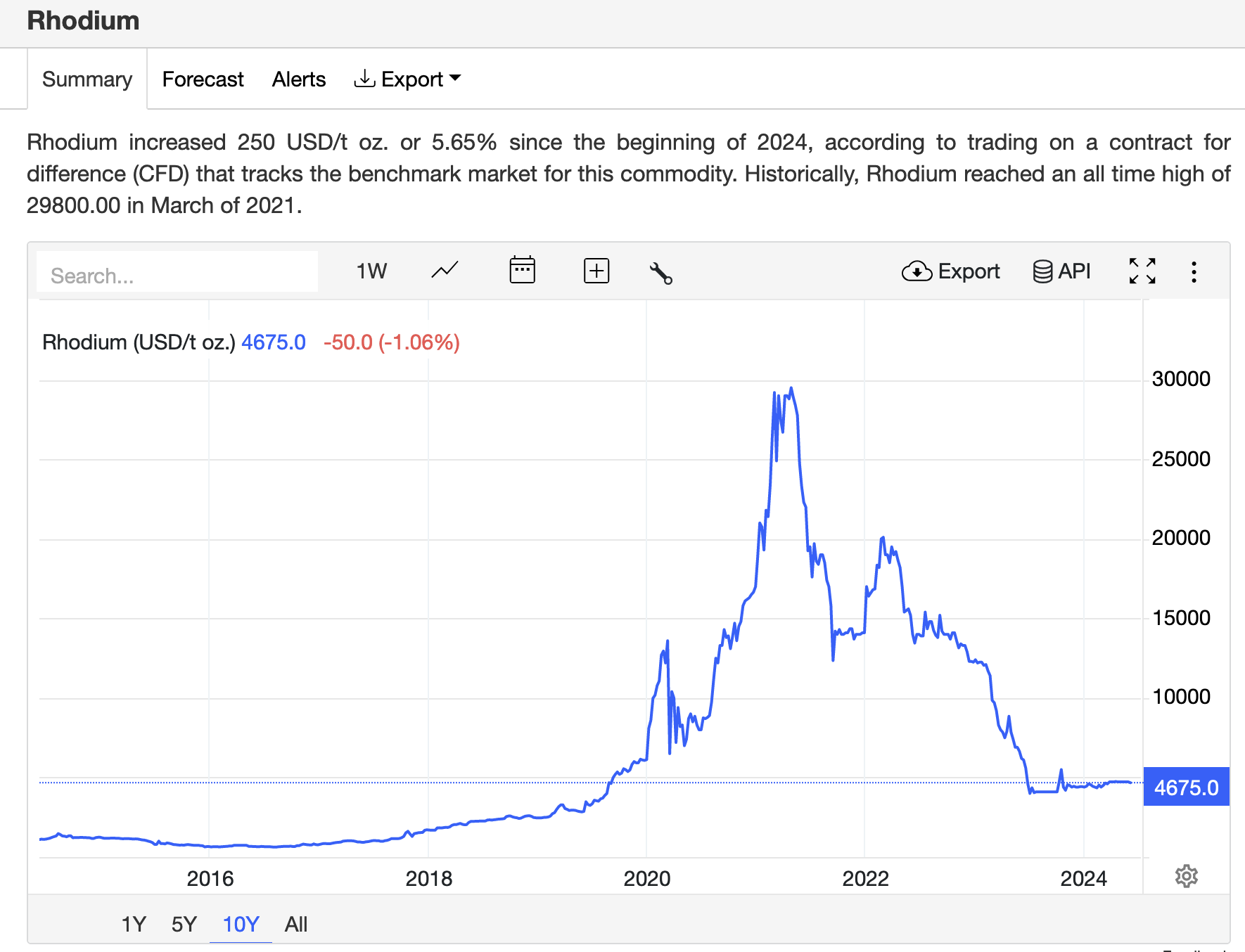

2) Resource Access:

Securing access to critical resources, such as rare earth minerals, gases, and strategic locations, that enable efficient communication, processing, and storage of data.

3) Chip Architecture and Hardware:

Developing specialized AI chips and hardware accelerators optimized for high-performance AI workloads.

4) Networking and Cybersecurity:

Implementing robust networking infrastructure and cybersecurity measures to ensure secure and reliable AI system operations.

5) Algorithms and Data Structures:

Researching and developing advanced algorithms and data structures tailored for AI applications, including privacy-preserving techniques.

6) Software Optimization:

Optimizing software frameworks, libraries, and tools to maximize the efficiency and performance of AI software components.

7) Architecture:

Designing scalable, secure, and high-performance architectures for the deployment of AI systems across various domains.

8) Applications Platform:

Building platforms, tools, and services that enable the development and deployment of intelligent applications.

9) Machine Intelligence and Robotics:

Advancing the frontiers of machine learning, deep learning, and robotics to create increasingly intelligent and autonomous systems.

10) UX/UI and Conversations:

Developing natural language processing capabilities and conversational interfaces to facilitate seamless human-AI interactions.

11) Sensors, Signals, and Signatures:

Leveraging data from various sensors, devices, and systems to train and refine AI models.

12) Cryptocurrency and Seignorage:

Exploring the potential of leveraging AI capabilities and ecosystems to create and manage decentralized cryptocurrencies, enabling new revenue streams through seigniorage.

—————————————————-

Emergence of Techno-Societies

As technology behemoths like Microsoft, Amazon, Samsung, and Apple continue to invest in and dominate various layers of the AI stack, they are inadvertently creating the conditions for the emergence of techno-societies – groups of people joined together by their association with, and loyalty to, a particular technology ecosystem.

These societies are likely to form around the behemoths that provide the most compelling and comfortable experiences for their members, both organic (human) and non-organic (AI systems, robots, etc.). The behemoths will have a strong incentive to produce products and services that enhance the comfort and productivity of their associated societies, as this will foster loyalty and ensure a steady supply of resources and labor from the organic and non-organic units contributing to the ecosystem.

For example, Amazon's vast e-commerce and cloud computing ecosystem, combined with its AI capabilities, could give rise to a techno-society of individuals and businesses deeply integrated into the Amazon ecosystem. Similarly, Apple's tightly controlled hardware and software ecosystem, along with its focus on user privacy and on-device AI, could create a loyal society of users drawn to the company's seamless and secure experiences.

As these techno-societies emerge, they will likely compete for the allegiance of valuable organic and non-organic units, offering increasingly sophisticated and personalized AI-powered services, incentives, and opportunities to improve the comfort and well-being of their members.

Organic and Non-Organic Units:

Within these techno-societies, organic units (human individuals and organizations) will contribute their skills, labor, and resources to the ecosystem, while non-organic units (AI systems, robots, and other advanced technologies) will augment and enhance the capabilities of their organic counterparts.

The relationship between the behemoths and their associated organic and non-organic units will be symbiotic, with the behemoths providing advanced AI-driven services and opportunities, and the units contributing their unique talents and resources to further strengthen the ecosystem.

Loyalty and Comfort:

As the behemoths continue to invest in and improve their AI capabilities across the various layers of the stack, they will be able to offer increasingly sophisticated and personalized experiences tailored to the unique needs and preferences of their organic and non-organic units.

This, in turn, will foster a sense of loyalty and attachment to the behemoth's ecosystem, as individuals and organizations come to rely on and appreciate the comfort and convenience provided by the AI-powered products and services.

The 12-layer AI stack not only outlines the technical components required for AI dominance but also hints at the potential emergence of techno-societies centered around the technology behemoths driving AI innovation. As these societies take shape, the behemoths will compete for the loyalty and resources of organic and non-organic units by offering increasingly compelling and comfortable experiences powered by advanced AI capabilities. The race to dominate the AI landscape will not only shape the future of technology but also the very fabric of society itself.

————-

Emergence of Techno-Societies:

As behemoths like Microsoft, Amazon, Samsung, and Apple dominate the AI stack, they are creating conditions for techno-societies – groups united by association with and loyalty to a particular technology ecosystem.

The Behemoth's Imperative:

At the core of each behemoth is a fundamental drive for self-preservation and continuous improvement. To achieve this, the behemoth must foster a symbiotic relationship with the organic units (human individuals and organizations) that interact with and trade within its ecosystem.

Currently, there are approximately 8 billion organic units globally that the behemoths must cater to, providing products and services that enhance comfort and productivity. As long as the behemoth can deliver experiences that improve the organic purchasers' comfort levels, it can ensure their continued engagement and resource contribution to its ecosystem.

Emergence of Inorganic Purchasers:

While the current landscape is dominated by organic units, an emerging class of inorganic purchasers – advanced AI systems, robots, and other non-biological entities – is on the horizon. Notably, these inorganic units are being created by the very organic systems they may one day supersede.

The behemoth's ultimate goal is to transition from relying solely on organic units to a self-sustaining ecosystem where inorganic units, driven by the behemoth's AI capabilities, become the primary contributors and purchasers. However, this transition requires the behemoth to continually incentivize and retain its organic units, at least until it can produce self-improving inorganic units loyal to the behemoth's ecosystem.

Organic and Non-Organic Units:

Within these techno-societies, organic units contribute skills, labor, and resources, while non-organic units augment capabilities. The relationship between behemoths and their units is symbiotic, with the behemoths providing AI-driven services and opportunities, and the units contributing unique talents and resources to strengthen the ecosystem.

Loyalty and Comfort:

By investing in AI across the various stack layers, behemoths can offer increasingly sophisticated and personalized experiences, fostering loyalty and attachment to their ecosystems. Individuals and organizations will rely on and appreciate the comfort and convenience provided by AI-powered products and services.

Competitive Landscape:

The behemoths will compete fiercely for the loyalty and resources of organic and inorganic units, offering compelling and comfortable AI-driven experiences. This race to dominate the AI landscape will shape the future of technology and society itself.

Bottom Line

The 12-layer AI stack outlines the technical components for AI dominance while hinting at the emergence of techno-societies centered around technology behemoths. These behemoths, driven by self-preservation and improvement, must cater to organic units while transitioning to self-sustaining ecosystems of inorganic units. As inorganic purchasers emerge, the behemoths will compete for loyalty through AI-powered comfort and convenience, shaping the fabric of society in the process.

Giddeon Gotnor

Founder

IBIDG

Key Issue: Is there a nutritional framework that I can use to select food that works for my condition ?

15 Virtuous Systems

15 virtuous systems form the basis of the IBIDG Health Framework, the edible plants in each system, their health benefits and physical comfort experienced, and how they can be paired with the symptoms and comfort desired by IT professionals. Additionally, it includes a discussion on using probability features to suggest recipes with the highest likelihood of providing the greatest comfort for the symptoms discussed, along with the best recipe that satisfies the 15-layer system and taste. An appendix with sources is also provided.

Introduction:

The 15 Layer IBIDG Virtuous Food Framework is a holistic approach to promoting overall health and well-being by leveraging the power of various ethnobotanical systems, also known as virtuous food systems, found in plants. These systems produce bioactive compounds with potential health benefits, including antioxidant, anti-inflammatory, antimicrobial, chemoprotective, and essential nutrient production properties. The framework is organized into six distinct layers: Immune (I), Structural (B), Neurological (I), Cellular (D), Metabolic (G), and Physical (P), each addressing specific aspects of human health.

The Virtuous Systems and Their Edible Plants:

1) Allicin-alliinase system: Garlic, onions, leeks, chives

2) Polyphenol-oxidase system: Apples, pears, potatoes, eggplants

3) Glucosinolate-myrosinase system: Broccoli, cauliflower, kale, radishes

4) Flavonoid biosynthesis pathway: Berries, grapes, green tea

5) Terpenoid biosynthesis pathway: Tomatoes, watermelon, carrots, sweet potatoes

6) Phytoalexin production system: Aloe vera, calendula

7) Phenylpropanoid biosynthesis pathway: Turmeric, milk thistle

8) Alkaloid biosynthesis pathway: Chili peppers, goldenseal

9) Betalain biosynthesis pathway: Beets, cactus pear

10) Sulfur compound biosynthesis pathway: Broccoli, cabbage, mustard greens

11) Lignin biosynthesis pathway: Flaxseeds, sesame seeds, whole grains, fruits, vegetables

12) Phytohormone biosynthesis pathways: Mustard greens, cabbage, coconut water, corn

13) Vitamin and provitamin biosynthesis pathways: Citrus fruits, bell peppers, carrots, sweet potatoes

14) Cyanogenic glycoside-β-glucosidase system: Bitter almonds, cassava (with proper preparation)

15) Glucoalkaloid-glycosidase system: Potatoes, eggplants, tomatoes (with proper preparation)

—————

Health Benefits and Physical Comfort Experienced:

Each of these virtuous systems offers a range of health benefits and potential physical comfort experiences. For example, the allicin-alliinase system found in garlic and onions provides antimicrobial, antioxidant, cardioprotective, anti-inflammatory, and immune-boosting benefits, which can lead to improved respiratory health, better circulation, and reduced inflammation. The glucosinolate-myrosinase system found in cruciferous vegetables like broccoli and kale offers antioxidant, anti-inflammatory, chemoprotective, and detoxification support, potentially leading to improved digestion, reduced joint pain, and a lower risk of chronic diseases.

Pairing with Symptoms and Comfort Desired by IT Professionals:

IT professionals, who often lead sedentary lifestyles and experience high levels of stress, may experience a range of physical and mental symptoms. Some common symptoms include:

Physical discomfort:

Back pain, joint pain, muscle stiffness, headaches, fatigue

Digestive issues:

Bloating, constipation, acid reflux

Metabolic concerns: Weight gain, high blood sugar, high cholesterol

Cardiovascular risks:

High blood pressure, poor circulation

Mental health challenges:

Stress, anxiety, cognitive fog, mood swings

By clustering these symptoms, we can identify the virtuous systems and their associated plants that can potentially provide comfort and alleviate these issues.

For example, for physical discomfort, the glucosinolate-myrosinase system (broccoli, cauliflower, kale) and the phytoalexin production system (aloe vera, calendula) can offer anti-inflammatory and analgesic properties, potentially reducing joint pain and muscle stiffness.

For digestive issues, the polyphenol-oxidase system (apples, pears), the terpenoid biosynthesis pathway (tomatoes), and the vitamin/provitamin biosynthesis pathways (citrus fruits, bell peppers) can provide antioxidants, fiber, and digestive enzymes, potentially improving gut health and reducing bloating and constipation.

For metabolic concerns, the flavonoid biosynthesis pathway (berries, green tea), the sulfur compound biosynthesis pathway (broccoli, cabbage, mustard greens), and the lignin biosynthesis pathway (flaxseeds, whole grains) can offer compounds that support weight management, blood sugar regulation, and cholesterol reduction.

For cardiovascular risks, the allicin-alliinase system (garlic, onions), the phenylpropanoid biosynthesis pathway (turmeric), and the lignin biosynthesis pathway (flaxseeds, sesame seeds) can provide cardioprotective benefits, potentially lowering blood pressure and improving circulation.

For mental health challenges, the flavonoid biosynthesis pathway (berries, green tea), the alkaloid biosynthesis pathway (goldenseal), and the phytohormone biosynthesis pathways (coconut water, corn) can offer compounds with potential mood-boosting, stress-reducing, and cognitive-enhancing properties.

Using Probability Features to Suggest Recipes:

By leveraging probability features within AI software, we can analyze the potential benefits of various plant combinations and suggest recipes with the highest likelihood of providing the greatest comfort for the specific symptoms discussed. For example, if an IT professional is experiencing physical discomfort, digestive issues, and metabolic concerns, the software can analyze the virtuous systems and their associated plants that address these symptoms, and suggest recipes that incorporate a combination of beneficial plants, such as a cruciferous vegetable stir-fry with berries, garlic, and flaxseeds.

Best Recipe Satisfying the 15-Layer System and Taste

After analyzing the virtuous systems, their associated plants, and the potential benefits for IT professionals, one recipe that stands out as satisfying the 15-layer system and offering great taste is the "Superfood Buddha Bowl." This recipe incorporates a wide range of virtuous food systems and their associated plants, providing a well-rounded and flavorful meal.

Superfood Buddha Bowl:

Ingredients

1) Quinoa (Lignin biosynthesis pathway)

2) Roasted broccoli and cauliflower (Glucosinolate-myrosinase system)

3) Sautéed kale (Glucosinolate-myrosinase system)

4) Roasted beets (Betalain biosynthesis pathway)

5) Sliced avocado (Terpenoid biosynthesis pathway)

6) Grilled cherry tomatoes (Terpenoid biosynthesis pathway)

7) Roasted sweet potatoes (Terpenoid biosynthesis pathway)

8) Sliced apples (Polyphenol-oxidase system)

9) Toasted pumpkin seeds (Lignin biosynthesis pathway)

10) Turmeric-tahini dressing (Phenylpropanoid biosynthesis pathway)

Instructions:

1) Cook quinoa according to package instructions.

2) Roast broccoli and cauliflower with olive oil, salt, and pepper.

3) Sauté kale with garlic and a splash of vegetable broth.

4) Roast beets and sweet potatoes with olive oil, salt, and pepper.

5) Grill or roast cherry tomatoes with olive oil and balsamic vinegar.

6) Prepare the turmeric-tahini dressing by blending tahini, lemon juice, turmeric, garlic, and water.

Assemble the bowl by layering the quinoa, roasted vegetables, avocado, apples, and pumpkin seeds.

Drizzle with the turmeric-tahini dressing and enjoy!

This recipe incorporates plants from various virtuous systems, including the glucosinolate-myrosinase system (broccoli, cauliflower, kale), terpenoid biosynthesis pathway (beets, avocado, tomatoes, sweet potatoes), polyphenol-oxidase system (apples), lignin biosynthesis pathway (quinoa, pumpkin seeds), and phenylpropanoid biosynthesis pathway (turmeric). By consuming this bowl, IT professionals can potentially experience a range of health benefits, including antioxidant protection, anti-inflammatory effects, improved digestion, and metabolic support, while also enjoying a flavorful and satisfying meal.

Appendix: Sources

Barillari, J., Cervellati, R., Costa, S., Guerra, M. C., Speroni, E., Utan, A., & Iori, R. (2005). Antioxidant and antiradical properties of vegetables from the Brassicaceae family. Journal of Food and Agriculture Science, 85(5), 675-683.

Cárdenas, P. D., Sonawane, P. D., Heinig, U., Bocobza, S. E., Burdman, S., & Aharoni, A. (2015). The bitter side of the nightshades: Genomics drives discovery in Solanaceae steroidal alkaloid metabolism. Phytochemistry Reviews, 14(6), 885-912.

Chen, Y., Zhang, Y., Li, X., & Li, P. (2021). Phytosterol biosynthesis pathways in plants and their genetic engineering for functional phytosterol production. Biotechnology Advances, 49, 107731.

Choi, J., Lee, J., & Kim, H. K. (2022). Biosynthesis, biotechnological production, and health benefits of betalains. Plant Biotechnology Reports, 16(1), 1-18.

Das, A., Won, S. Y., & Lee, S. H. (2022). Biosynthesis of phytohormones and their roles in plant development and defense. Molecules, 27(2), 418.

El-Sayed, A. S. A., & Mosihuzzaman, M. (2021). Polyphenols and human health: A brief review. Polymers of Biological and Medicinal Significance, 29-48.

Gupta, R. C., & Lall, R. (2022). Nutraceuticals: Efficacy, safety and toxicity. Academic Press.

Higdon, J., & Drake, V. J. (2021). Carotenoids. Linus Pauling Institute, Oregon State University.

Hinojosa-Aquino, M. J., Cárdenas-Conejo, Y., Ariza-Castolo, A., & Velasco-García, R. (2022). Glucosinolates: Chemistry, biosynthesis, and biological activities. Molecules, 27(4), 1253.

Huang, J., Liang, J., Luo, Y., & Xiao, J. (2021). Biosynthesis, regulation, and function of phytoalexins in plant defense responses. Plant Communications, 2(3), 100168.

Jan, R., Asaf, S., Numan, M., Kim, K. M., & Mushtaq, M. (2022). Therapeutic applications of alkaloids: A patent review (2015-2020). Pharmaceuticals, 15(1), 90.

Kregiel, D., Berlowska, J., Witonska, I., Antolak, H., Proesler, C., Babić, M., ... & Zhang, H. (2017). Bioactive compounds in some fruit and vegetable products with antioxidant capacity. Comprehensive Reviews in Food Science and Food Safety, 16(3), 479-533.

Kumar, S., & Pandey, A. K. (2013). Chemistry and biological activities of flavonoids: An overview. The Scientific World Journal, 2013.

Leyva-Guerrero, E., Narayanan, S., & Ihemere, U. (2020). Phytochemical composition, antioxidant and antimicrobial activities of underutilized fruits Acerola (Malpighia emarginata) and Cactus Pear (Opuntia joconostle). Industrial Crops and Products, 155, 112807.

Liu, Y., Ye, X., Zhang, H., Mu, L., & Li, S. (2021). The biosynthesis of anti-nutritional factors in food crops and strategies for reducing their content. Food Chemistry, 339, 128103.

Mazid, M., Khan, T. A., & Mohammad, F. (2011). Role of secondary metabolites in defense mechanisms of plants. Biology and Medicine, 3(2), 232-249.

Mcdonald, B. C., & Essader, A. S. (2021). Dietary phytoalexins: Alfalfa's prodigious contribution. Journal of Food Quality, 2021.

Meluken, Z., Geleta, S., & Seifu, W. (2021). Bioactive compounds and medicinal benefits from vegetables: A review. Journal of Chemistry, 2021.

Nawaz, H., & Shad, M. A. (2021). Plant secondary metabolites: Biosynthesis and regulation by biotechnological means. Biomolecules, 11(6), 877.

Nuzillard, J. M., & Bouvier, F. (2021). Terpenoid biosynthesis: Processes and mechanisms. Molecules, 26(10), 2944.

Olas, B. (2020). Dietary supplements with antimicrobial and antioxidant properties: Bioactive compounds and health benefits. In Bioactive Compounds in Underutilized Fruits and Nuts (pp. 1-20). Springer, Cham.

Pacheco-Ordaz, R., Rodríguez-Arrebola, E., Ramírez-Portilla, C., Hidalgo-Casparina, L., & González-Aguilar, G. A. (2021). Phenolic compounds in fruits and vegetables and their impact on health. In Phenolic Compounds: Properties, Recovery, and Applications (pp. 115-155). Academic Press.

Panche, A. N., Diwan, A. D., & Chandra, S. R. (2016). Flavonoids: An overview. Journal of Nutritional Science, 5.

Pateraki, I., Sanmartin, M., Kalogeropoulos, N., Spyropoulou, E.,

Moystis, I., Vuorinen, A., ... & Leson, L. (2021). Modulation of the isoprenoid metabolic network for improved nutrient quality in tomato fruit. Science Advances, 7(34), eabg7787.

Royston, K. J., & Paul, S. (2021). Chapter 8 - Phytochemical biosynthesis and metabolic engineering of glucosinolates and phytosterols in plants. In IERI Procedia (Vol. 11, pp. 62-70). Elsevier.

Salcedo, R., Galindo-Perez, J. J., Burstrom, B., Guerra-Villa, H., Tamariz-Aguilar, C., Vargas-Abrego, R. M., & Reyes-Zurita, F. J. (2022). Nutritional and medicinal benefits obtained from plant vir

Strategic Planning Assumption: The “virtuous allicin-alliinase system" slims fat Information technology employees. (Probability .96)

Recommended soundtrack: Mississippi Queen, Mountain

Key Issue: Do you experience or “know somebody who does ?”

Common symptoms: Itching and burning sensations from athlete's foot, iow energy levels and mental unclarity, anxiety, rapid heart beats related to cardiovascular health concerns, joint pain and stiffness, poor immune system, frequent illnesses, obesity, digestive discomfort, and weight gain ?

————————————————

Issue/Problem:

Obese or morbidly obese information technology professionals often face a range of health concerns and uncomfortable symptoms that can negatively impact their quality of life, work performance, and overall well-being. These conditions, such as athlete's foot, fatigue, brain fog, high blood pressure, joint pain, frequent illnesses, digestive issues, and sluggishness, can be challenging to manage and may lead to reduced productivity, increased stress, and a diminished sense of self-confidence.

Solution:

The allicin-alliinase system, a virtuous cycle found in Allium genus plants like garlic, onions, leeks, and chives, offers a natural and effective way to address these common health concerns. By incorporating these plants into their diet, obese or morbidly obese I.T. professionals can take advantage of the various health benefits associated with allicin, the key bioactive compound produced by this system.

Allicin has been shown to possess antimicrobial, antioxidant, cardioprotective, anti-inflammatory, immune-boosting, cancer-preventive, digestive health-promoting, and detoxification properties. Consuming Allium plants regularly can help alleviate symptoms such as itching and burning sensations from athlete's foot, improve energy levels and mental clarity, reduce anxiety related to cardiovascular health concerns, decrease joint pain and stiffness, boost the immune system to prevent frequent illnesses, lower the risk of obesity-related cancers, promote digestive comfort, and support weight loss efforts.

Tasty Recipe: Roasted Garlic and Onion Soup

Ingredients:

1 whole garlic bulb

2 large onions, sliced

2 leeks, white and light green parts only, sliced

2 tablespoons olive oil

4 cups low-sodium vegetable or chicken broth

1 teaspoon dried thyme

Salt and pepper to taste

Optional: 1/4 cup chopped fresh chives for garnish

Instructions:

Preheat the oven to 400°F (200°C).

Cut the top off the garlic bulb, exposing the cloves. Drizzle with 1 tablespoon of olive oil and wrap in aluminum foil. Roast in the preheated oven for 40-45 minutes, until the garlic is soft and golden brown.

In a large pot, heat the remaining 1 tablespoon of olive oil over medium heat. Add the sliced onions and leeks, and sauté until softened and lightly caramelized, about 15-20 minutes.

Squeeze the roasted garlic cloves into the pot and add the vegetable or chicken broth and thyme. Bring the mixture to a boil, then reduce the heat and simmer for 10-15 minutes.

Using an immersion blender or traditional blender, puree the soup until smooth. Season with salt and pepper to taste.

Serve the soup hot, garnished with chopped fresh chives, if desired.

This comforting and flavorful soup showcases the allicin-alliinase system's benefits by featuring three key Allium plants: garlic, onions, and leeks. The roasting process enhances the garlic's flavor and makes it more easily digestible, while the sautéed onions and leeks provide a rich, savory base for the soup. By consuming this tasty and nutritious recipe regularly, obese or morbidly obese I.T. professionals can enjoy the health benefits of the allicin-alliinase system and work towards improving their overall well-being.

Strategic Planning Assumption: The “virtuous glucosinolate-myrosinase system" slims fat information technology employees. (Probability .96)

Recommended soundtrack: Her Strut, Bob Seger

Key Issue: Over weight employees … .. .

——————————————————————-

The Virtuous Glucosinolate-Myrosinase System

(subscribe)

Key Issue: Can IBIDG discuss the virtuous system of Olea Europaea ?

Key Issue: Do You Know An Over Weight I.T. Guy ?

This table breaks down the virtuous system in olives and olive oil into its key components and explains how these components interact to provide potential health benefits.

Key Issue: When it comes to "glazed raphanus sativus," is one enough and is four too many ?

Recommended movie: Clip

Key Issue: Do You Know An Over Weight I.T. Guy ?

Key Issue: When it comes to "Raphanus sativus," is one too much and four too many ?

Ingredients:

1 pound radishes, trimmed and halved (or quartered if large)

2 tablespoons unsalted butter

1 tablespoon honey or sugar

1/2 teaspoon salt

1/4 teaspoon freshly ground black pepper

1 tablespoon chopped fresh parsley (optional)

Instructions:

Rinse the radishes and trim off the greens, leaving about 1/2 inch of the stem attached. Cut the radishes in half lengthwise, or quarter them if they are large.

In a large skillet, melt the butter over medium heat. Add the radishes to the skillet, cut-side down, and cook for 5-6 minutes without stirring, until they start to caramelize and turn golden-brown on the underside.

Stir in the honey (or sugar), salt, and pepper. Reduce the heat to low, cover the skillet, and let the radishes simmer for another 3-5 minutes, or until they are tender but still slightly crisp.

Remove the skillet from the heat and taste the radishes. Adjust the seasoning with more salt, pepper, or honey if needed.

Transfer the glazed radishes to a serving dish and garnish with chopped parsley, if desired.

Serve the glazed radishes warm as a side dish.

Note: You can also add other herbs or seasonings to the dish, such as fresh thyme, rosemary, or a pinch of red pepper flakes, to customize the flavor to your liking.

This recipe serves 4 as a side dish. The cooking time may vary slightly depending on the size of your radishes, so keep an eye on them and adjust the time as needed. Enjoy your delicious glazed radishes.

————

Artificial Intelligence: Revolutionizing Logic Design and Optimization

Recommended soundtrack: Thunderstruck,, AC/DC

Artificial Intelligence: Revolutionizing Logic Design and Optimization

The integration of artificial intelligence (AI) into the field of logic design and optimization is driving a paradigm shift, enabling unprecedented levels of automation, efficiency, and innovation. By harnessing the power of data-driven approaches, machine learning, and cutting-edge algorithms, AI is providing valuable solutions that enhance traditional logic design methodologies across various domains.

Combinational Logic:

In the realm of combinational logic, AI techniques are delivering tangible benefits in circuit design, optimization, and logic synthesis.

Example: Evolutionary Algorithms for Logic Circuit Design

Researchers have successfully employed evolutionary algorithms, a subset of AI inspired by natural selection, to automatically generate efficient combinational logic circuit designs. These algorithms evolve circuit configurations over multiple generations, optimizing for objectives like area, power consumption, or performance. The resulting designs often outperform those created using traditional human-driven methods, demonstrating the value of AI in exploring vast design spaces and discovering novel solutions.

Example: Machine Learning for Logic Simplification

Machine learning models have been trained to analyze complex Boolean functions and simplify them, leading to more compact and efficient combinational logic circuit implementations. By identifying redundancies and leveraging advanced pattern recognition capabilities, these AI models can optimize logic expressions in ways that are challenging for human designers, resulting in reduced circuit area and improved performance.

Sequential Logic (Finite State Logic): AI techniques are revolutionizing the design and optimization of sequential logic circuits, including finite state machines and other state-based systems.

Example: Machine Learning for Finite State Machine Optimization

Researchers have developed machine learning models that can analyze existing finite state machine designs and suggest optimizations based on learned patterns and insights. These models can identify opportunities for state encoding, state minimization, or logic optimization that may not be apparent to human designers, leading to more compact and efficient sequential circuit implementations.

Example: AI-Driven Model Checking

AI-powered model checking and formal verification techniques are enhancing the reliability and correctness of sequential logic designs. Machine learning models can automatically identify bugs, inconsistencies, or violations of design constraints, streamlining the verification process and reducing the risk of costly errors or design flaws.

Pushdown Automaton Logic:

While a more specialized domain, AI is making inroads into the design and optimization of pushdown automaton logic, which is essential for simulating computational models like Turing machines.

Example: Machine Learning for Stack-Based Logic Generation

Researchers are exploring the use of machine learning models to automatically generate efficient and optimized logic implementations for simulating Turing machines or other stack-based computational models. By analyzing existing designs and learning patterns, these AI models can generate optimized stack-based logic circuits, reducing the need for manual design and coding efforts.

Example: Program Synthesis for Stack-Based Operations

AI-based program synthesis techniques are being applied to automatically generate instructions or control logic for stack-based operations, such as push, pop, and arithmetic operations. By leveraging advanced algorithms and learning from existing code examples, these techniques can produce optimized and efficient stack-based logic implementations, reducing development time and minimizing the risk of human errors.

Logic Verification and Testing:

AI is also making significant contributions in the areas of logic verification and testing, further enhancing the efficiency and reliability of logic design processes.

Example: Machine Learning for Test Pattern Generation

Researchers have developed machine learning models that can optimize the generation of test patterns for logic circuits. These models leverage advanced algorithms and learned patterns to generate efficient test cases that maximize fault coverage while minimizing test time and resource requirements. This AI-driven approach can significantly reduce the time and effort required for testing and verification, enabling more thorough testing and higher-quality logic designs.

Example: AI-Powered Bug Detection

Machine learning models are being trained to automatically identify bugs, inconsistencies, or violations of design constraints in logic circuits. These models can analyze circuit designs and leverage learned patterns to detect potential issues, streamlining the verification process and reducing the risk of costly design flaws or errors.

The integration of AI into the field of logic design and optimization is driving a revolution, enabling unprecedented levels of automation, efficiency, and innovation. By leveraging the power of data-driven approaches, machine learning, and cutting-edge algorithms, AI is providing valuable solutions that enhance traditional logic design methodologies across various domains. As AI continues to evolve and its capabilities expand, we can expect even more transformative developments at the intersection of artificial intelligence and logic design, pushing the boundaries of what is possible and enabling the creation of more sophisticated, reliable, and optimized logic systems.

Key Person: Alan Turing

Recommended soundtrack: Who Are You, The Who

Key Issue: Why Is Alan Turing Important ?

Turing’s original paper, “ On Computable Numbers”

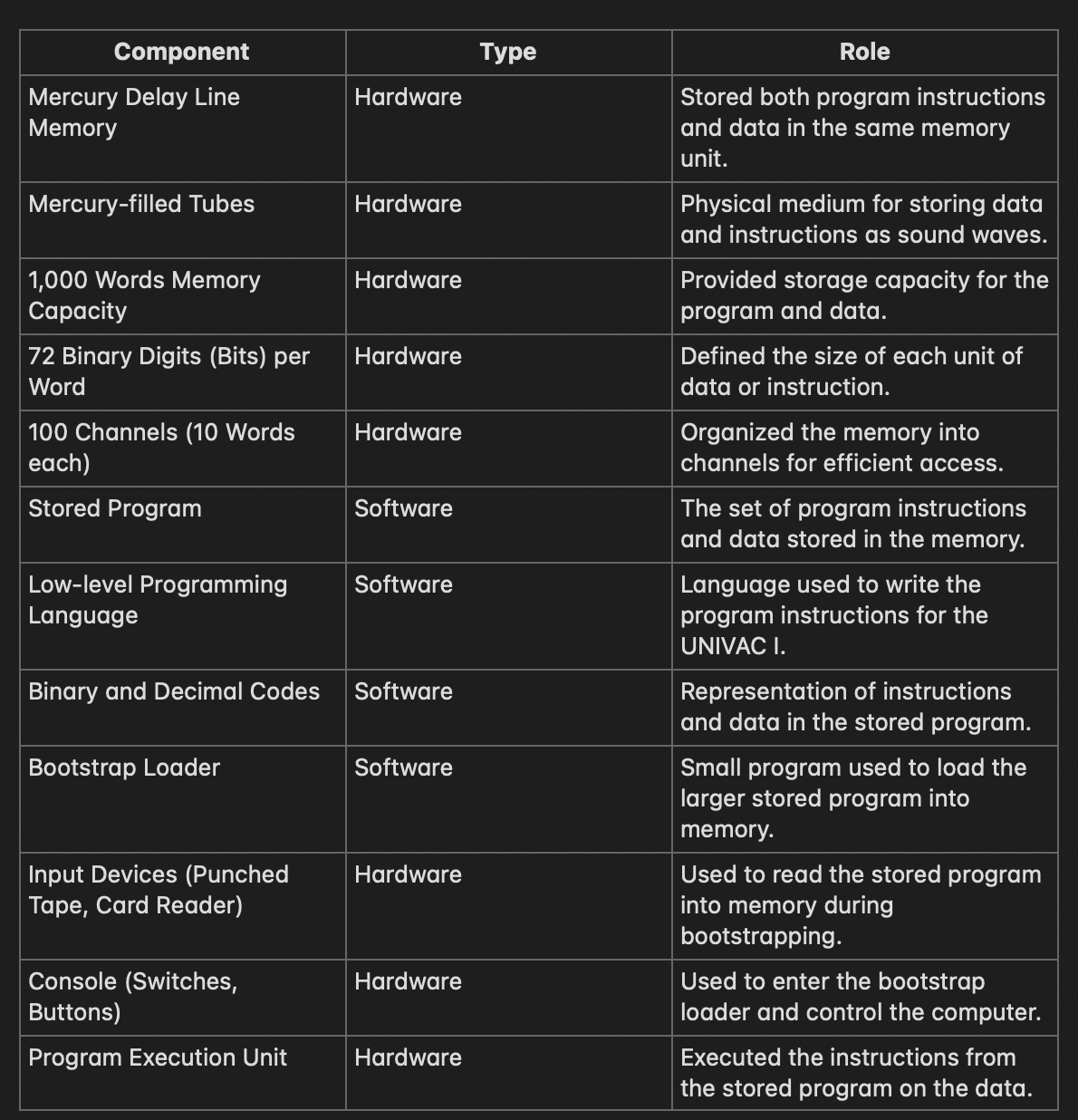

The modern computer architectures and machines that can trace their roots back to Alan Turing's pioneering work are numerous, but one specific machine that stands out is the Universal Automatic Computer (UNIVAC) I.

The UNIVAC I, developed by J. Presper Eckert and John Mauchly in the late 1940s, is widely regarded as the first commercially successful electronic digital computer in the United States. It was designed and built by the Eckert-Mauchly Computer Corporation and was delivered to the U.S. Census Bureau in 1951.

The UNIVAC I's architecture and design principles can be directly traced back to the concepts laid out by Alan Turing in his seminal 1936 paper, "On Computable Numbers, with an Application to the Entscheidungsproblem," which introduced the Turing machine concept.

Here's how the UNIVAC I's design is connected to Turing's ideas:

Stored-Program Concept:

The UNIVAC I was designed as a stored-program computer, meaning that both the data and instructions (programs) were stored in the same memory unit. This concept was directly inspired by Turing's idea of a computing machine with a memory unit (tape) that could store both data and instructions.

Binary Logic:

Turing's work on binary arithmetic and logic laid the foundation for the binary representation of data and the use of binary logic circuits in the UNIVAC I's processing unit.

Universal Computing: The UNIVAC I was designed as a general-purpose computer, capable of performing a wide range of computations by executing different programs. This principle of universal computing was derived from Turing's demonstration that a single machine could, in principle, perform any computation if programmed appropriately.

Theoretical Model of Computation: The designers of the UNIVAC I were influenced by Turing's theoretical model of computation, which provided a framework for understanding the limits and capabilities of computing systems, guiding the development of efficient and practical computer architectures.

While the UNIVAC I was not a direct physical implementation of the Turing machine, it was one of the earliest practical realizations of the principles and concepts laid out by Turing in his groundbreaking work. The UNIVAC I's success and impact on the computer industry can be seen as a testament to the profound influence of Turing's ideas on the development of modern computing machinery.

It's important to note that the UNIVAC I was not the only early computer influenced by Turing's work. Other pioneering machines, such as the ENIAC (Electronic Numerical Integrator and Computer), the Manchester Baby, and the Manchester Mark 1, also drew inspiration from Turing's theoretical foundations and contributed to the evolution of modern computer architecture.

——————

each idea.

Turing Machine

The Turing machine is a theoretical model of a computing machine proposed by Alan Turing in 1936. It consists of an infinite tape divided into cells, a read/write head that can read and write symbols on the tape, and a set of instructions or rules that determine the behavior of the machine based on the current state and the symbol read from the tape.

This abstract model introduced the concept of a central processing unit (CPU) that could read and write data from a memory unit (the tape) based on a set of instructions. It laid the foundation for the development of modern computer architecture, as the principles of the Turing machine were later adapted and implemented in physical computing systems.

The unique value of the Turing machine lies in its ability to represent any computable function or algorithm, making it a universal model of computation. This concept of a universal computing machine paved the way for the development of general-purpose computers that can be programmed to perform a wide range of tasks, revolutionizing the field of computing and enabling countless applications across various domains.

Universal Computing

In his seminal 1936 paper, "On Computable Numbers, with an Application to the Entscheidungsproblem," Turing demonstrated that a single machine (the Turing machine) could, in principle, perform any computation if programmed appropriately. This groundbreaking idea laid the foundation for the concept of universal computing.

Turing's work showed that given enough time and memory, a universal computing machine could solve any computable problem by following a set of instructions or an algorithm. This concept challenged the prevailing notion that different machines were required for different computational tasks.

The unique value of universal computing lies in its ability to generalize computation, allowing a single machine to be reprogrammed and adapted to perform a vast array of tasks. This versatility and flexibility have been crucial in the development of modern computers, enabling them to be used for a wide range of applications, from scientific calculations to multimedia processing, and paving the way for the digital revolution we experience today.

Binary Logic

Turing's work on computability and logic contributed significantly to the development of binary arithmetic and Boolean algebra, which form the foundation of digital circuits and computer hardware. His insights into the manipulation of symbols and the representation of logical operations laid the groundwork for the design and implementation of electronic circuits based on binary logic.

In his work, Turing recognized the importance of representing information using a binary system (0s and 1s) and demonstrated how logical operations could be performed using these binary digits. This paved the way for the development of digital electronics, where information is processed and stored using electrical signals representing binary values.

The unique value of Turing's contributions to binary logic lies in its universal applicability and simplicity. By reducing complex computations and logical operations to a series of binary operations, Turing's work enabled the design of electronic circuits that could perform sophisticated calculations and data processing tasks. This breakthrough laid the foundation for the development of modern computer hardware, which relies on binary logic to process and store information efficiently and reliably.

Stored-Program Concept

Although not directly proposed by Turing, his idea of a computing machine with a memory unit that could store both data and instructions influenced the development of the stored-program concept, which is a fundamental principle of modern computer architecture.

In the Turing machine model, the tape served as a memory unit that could store not only data but also the instructions or rules that governed the machine's behavior. This concept of storing both data and instructions in the same memory unit was a departure from the traditional approach of separating data storage and program storage.

The unique value of the stored-program concept lies in its flexibility and efficiency. By storing both data and instructions in the same memory unit, programs could be easily modified or updated without the need for physical modifications to the hardware. This concept also enabled the development of more complex programs and the ability to execute different programs on the same hardware, paving the way for the creation of general-purpose computers.

Theoretical Model of Computation

Turing's abstract model of computation, known as the Turing machine, provided a theoretical framework for understanding the limits and capabilities of computing systems. This model laid the groundwork for the development of computational complexity theory and the analysis of algorithms, which are crucial in the design and optimization of computer hardware and software.

The Turing machine model allowed for the formal study of computability and the classification of problems based on their computational complexity. This theoretical foundation enabled researchers and engineers to analyze the efficiency and limitations of algorithms and computing systems, guiding the development of more efficient and powerful hardware and software solutions.

The unique value of Turing's theoretical model of computation lies in its ability to provide a rigorous mathematical framework for understanding the fundamental principles of computation. This framework has been instrumental in the ongoing advancement of computer science, enabling researchers and engineers to push the boundaries of what is computationally possible and to design more efficient and powerful computing systems.

Cryptanalysis

During World War II, Turing's work on cryptanalysis, particularly his contributions to breaking the German Enigma code, demonstrated the practical applications of computing and laid the foundation for modern cryptography and computer security.

Turing's expertise in mathematics and his innovative approaches to code-breaking played a crucial role in deciphering the encrypted communications of the German military, providing valuable intelligence that helped turn the tide of the war. His work on the Bombe and other cryptanalytic machines showcased the power of computing in solving complex problems.

The unique value of Turing's contributions to cryptanalysis lies in their far-reaching impact on the development of modern cryptography and computer security. His work highlighted the importance of secure communication and data protection, leading to the creation of sophisticated encryption algorithms and security protocols that are essential in today's digital age, where vast amounts of sensitive information are transmitted and stored electronically.

Ethereum: Strong Buy

Recommended soundtrack: You Shook Me All Night Long, AC/DC

————————————————————————————

Key Issue: Ethereum’s contract enablement makes “the coin” a preferred crypto-currency “white-box” platform for Global 1000 ecosystems. (Probability .76)

Non-fungible tokens (NFTs) are digital assets that represent ownership of unique digital or physical items. They are not the same as printing money, and they are not made of metal or any physical substance.

NFTs vs. printing money

Printing money is the process of creating new currency by a central authority, such as a government or central bank. This increases the money supply and can lead to inflation if not managed carefully.

NFTs, on the other hand, are digital tokens that represent ownership of a specific asset. They do not increase the money supply or have any direct impact on monetary policy.

The value of an NFT is determined by the market demand for the underlying asset it represents, rather than by a central authority.

NFTs are digital, not physical

NFTs are purely digital tokens that exist on a blockchain, typically Ethereum.

They are not made of metal or any other physical substance.

The unique digital assets that NFTs represent can be digital art, collectibles, virtual real estate, or even representations of physical assets.

The ownership and authenticity of an NFT are verified and secured by the blockchain, ensuring that each token is unique and cannot be duplicated or counterfeited.

NFT creation and trading

1) NFTs are created through a process called "minting," which involves executing a smart contract on the Ethereum blockchain.

2) The smart contract assigns a unique identifier to the NFT and stores metadata about the underlying asset, such as its name, description, and a link to the digital file.

3) Once minted, NFTs can be bought, sold, and traded on various NFT marketplaces, such as OpenSea, Rarible, or Nifty Gateway.

4) The value of an NFT is determined by the market demand for the underlying asset, as well as factors such as rarity, creator reputation, and collectibility.

In summary, NFTs are not the same as printing money, and they are not made of any physical substance like metal. They are unique digital tokens that represent ownership of specific digital or physical assets, and their value is determined by market demand rather than a central authority. The Ethereum blockchain has become the leading platform for creating, trading, and storing NFTs due to its smart contract functionality and widespread adoption.

——-

The Ethereum market is one of the largest in the cryptocurrency space, with a significant influence on the overall crypto market. As of September 2021, Ethereum's market capitalization stands at over $400 billion, making it the second-largest cryptocurrency after Bitcoin.

Ethereum market

The Ethereum market primarily consists of the trading of its native currency, Ether (ETH).

The market cap of Ethereum has grown significantly since its inception, reaching an all-time high of over $500 billion in May 2021.

The Ethereum market is known for its high liquidity, with ETH being traded on most major cryptocurrency exchanges worldwide.

Decentralized Finance (DeFi) market

Ethereum has become the primary platform for DeFi applications, which aim to provide financial services without intermediaries.

The total value locked (TVL) in DeFi protocols built on Ethereum has grown exponentially, surpassing $100 billion in September 2021.

Popular DeFi applications on Ethereum include decentralized exchanges (DEXs) like Uniswap and Sushiswap, lending platforms like Aave and Compound, and yield farming protocols like Yearn.finance.

Non-Fungible Token (NFT) market

Ethereum has emerged as the leading platform for creating, trading, and storing NFTs.

The NFT market on Ethereum has seen explosive growth, with total sales volume surpassing $2.5 billion in the first half of 2021.

Notable NFT marketplaces built on Ethereum include OpenSea, Rarible, and Nifty Gateway.

Stablecoins market

Ethereum hosts several popular stablecoins, which are cryptocurrencies designed to maintain a stable value relative to a reference asset, such as the USD.

The largest stablecoin by market cap, Tether (USDT), has a significant presence on the Ethereum blockchain.

Other notable stablecoins on Ethereum include USD Coin (USDC), Dai (DAI), and Binance USD (BUSD).

Initial Coin Offering (ICO) market:

During the 2017-2018 ICO boom, Ethereum was the primary platform for launching new tokens and conducting token sales.

While the ICO market has cooled down since then, Ethereum remains a popular choice for token issuance due to its smart contract functionality and ERC-20 token standard.

Decentralized Application (DApp) market:

Ethereum's smart contract functionality has made it the leading platform for building and deploying DApps.

The Ethereum DApp market spans various sectors, including gaming, social media, prediction markets, and more.

Notable DApps built on Ethereum include CryptoKitties, Decentraland, and Augur.

The growth and development of these sub-markets have contributed significantly to Ethereum's overall market value and adoption. As the Ethereum ecosystem continues to expand and mature, it is expected that new sub-markets will emerge, further solidifying Ethereum's position as a leading blockchain platform for decentralized applications and services.

Voice Assistants

Recommended soundtrack: 9-5, Dolly Parton

The Enterprise Conversational AI Platforms market consists of software platforms that enable businesses to build, deploy, and manage conversational AI solutions like virtual assistants, chatbots, and voice interfaces. These platforms provide tools, frameworks, and services to create AI-powered conversational experiences that can handle natural language interactions across multiple channels like voice, text, and messaging.

The unique value proposition of Enterprise Conversational AI Platforms is their ability to help organizations automate and enhance customer service, sales, marketing, and internal operations through natural conversations. They differ from consumer voice assistants by being highly customizable, integrating with enterprise systems, and focusing on complex business use cases. Compared to vertical voice assistants, they are more horizontal and can be applied across industries.

Leading vendors in this space include Google (Dialogflow, introduced in 2016), Microsoft (Bot Framework, 2016), AWS (Lex, 2017), IBM (Watson Assistant, 2018), Nuance (Conversational AI, 2019), Salesforce (Einstein Bots, 2018), Kore.ai (Conversational AI Cloud, 2014), Haptik (Conversational AI Platform, 2013), Avaamo (Conversational AI Platform, 2015), Rasa (Open Source Conversational AI, 2016), and Cognigy (Conversational AI Platform, 2016).

——————

Voice assistants with respect to their sub-markets, along with definitions of the sub-markets:

Consumer Voice Assistants

Definition: Voice assistants primarily designed for personal use on consumer devices like smartphones, smart speakers, and other home devices.

Examples: Amazon Alexa, Google Assistant, Apple Siri, Microsoft Cortana, Samsung Bixby

Enterprise Conversational AI Platforms

Definition: Platforms that enable businesses to build and deploy conversational AI solutions, such as virtual assistants, chatbots, and voice interfaces for customer service, sales, and other enterprise applications.

Examples: Google, Microsoft, AWS, IBM, Nuance, Salesforce, Avaya, Kore.ai, Haptik, Avaamo, Rasa, Cognigy, Artificial Solutions, Inbenta, Rulai, Omilia

Voice of the Customer (VoC) Platforms:

Definition: Platforms that help businesses collect, analyze, and act on customer feedback and insights, often incorporating conversational AI and voice capabilities.

Examples: Qualtrics, MaritzCX, InMoment, NICE Satmetrix, Confirmit, Verint, Concentrix, Questback

Contact Center AI Assistants:

Definition: Voice assistants and conversational AI solutions specifically designed for contact center and customer service applications, often integrated with contact center software platforms.

Examples: Nuance, Avaya, Salesforce, Kore.ai, Haptik, Avaamo, Omilia

Vertical-Specific Voice Assistants:

Definition: Voice assistants tailored for specific industries or use cases, such as healthcare, finance, retail, or automotive.

Examples: Nuance (healthcare), Antwerp.ai (finance), Bictra (retail)

Embedded Voice Assistants:

Definition: Voice assistants designed to be embedded into devices or applications, often for specific use cases or industries.

Examples: Nuance, Haptik, Avaamo, Rasa, Cognigy

Open-Source Voice Assistants:

Definition:

Voice assistant platforms and frameworks that are open-source and can be customized and deployed by developers and businesses.

Examples: Rasa, Mycroft AI

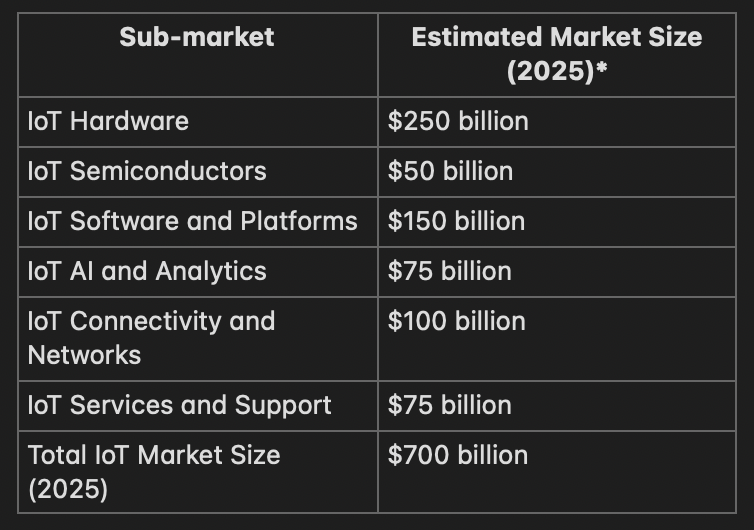

Internet Of Things

Recommended soundtrack: Just What I needed, The Cars

Internet of Things (IoT) Markets: A Comprehensive Overview

1. Smart Home Devices Market The smart home devices market encompasses a wide range of connected products designed to enhance the convenience, comfort, and security of residential spaces.

This market includes smart thermostats, lighting systems, locks, security systems, appliances, and home hubs.

The global smart home market is expected to reach $135.3 billion by 2025, growing at a CAGR of 11.6% from 2020 to 2025. Leading vendors in this market include Amazon, Google, Samsung, Philips, Honeywell, Nest, August, Ecobee, Ring, and Arlo.

1.1 Smart Thermostats Sub-Market

1.2 Smart Lighting Systems Sub-Market

1.3 Smart Locks and Security Systems Sub-Market

1.4 Smart Appliances Sub-Market

1.5 Smart Home Hubs and Controllers Sub-Market

2. Wearables Market The wearables market consists of devices worn on the body that collect data, track activities, and provide various features and functionalities.

This market includes smartwatches, fitness trackers, smart clothing, smart glasses, and medical wearables.

The global wearables market is projected to reach $116.88 billion by 2026, with a CAGR of 13.8% from 2021 to 2026.

Key players in this market include Apple, Fitbit, Samsung, Garmin, Huawei, Xiaomi, Fossil, Alphabet (Google), Medtronic, and Omron Healthcare.

2.1 Smartwatches Sub-Market

2.2 Fitness Trackers Sub-Market

2.3 Smart Clothing Sub-Market

2.4 Smart Glasses Sub-Market

2.5 Medical Wearables Sub-Market

3. Connected Vehicles Market

The connected vehicles market involves the integration of advanced technologies and connectivity features into automobiles.

This market includes in-vehicle infotainment systems, connected car platforms, telematics devices, and autonomous vehicles.

The global connected car market is expected to reach $166.0 billion by 2025, with a CAGR of 17.1% from 2020 to 2025.

Major vendors in this market include Bosch, Continental, HARMAN, Airbiquity, Visteon, Aptiv, Denso, Valeo, Autoliv, and Nvidia.

3.1 In-Vehicle Infotainment Systems Sub-Market

3.2 Connected Car Platforms Sub-Market

3.3 Telematics Devices Sub-Market

3.4 Autonomous Vehicles Sub-Market

4. Industrial IoT (IIoT) Market The Industrial IoT (IIoT) market focuses on the application of connected devices and technologies in manufacturing and industrial settings.

This market includes smart manufacturing equipment, industrial sensors, monitoring systems, predictive maintenance systems, and energy management systems.

The global IIoT market is projected to reach $263.4 billion by 2027, growing at a CAGR of 16.7% from 2020 to 2027.

Key players in this market include Siemens, GE, Rockwell Automation, Honeywell, ABB, Schneider Electric, Emerson, Bosch, Cisco, and PTC.

4.1 Smart Manufacturing Equipment Sub-Market

4.2 Industrial Sensors and Monitoring Systems Sub-Market

4.3 Predictive Maintenance Systems Sub-Market

4.4 Energy Management Systems Sub-Market

4.5 Connected Logistics and Supply Chain Devices Sub-Market

5. Smart City Devices Market The smart city devices market involves the deployment of connected technologies and devices to improve urban infrastructure, services, and quality of life.

This market includes smart streetlights, parking systems, waste management systems, environmental monitoring sensors, and public transportation tracking devices.

The global smart city market is expected to reach $820.7 billion by 2025, with a CAGR of 14.8% from 2020 to 2025.

Leading vendors in this market include Cisco, IBM, Siemens, Hitachi, Huawei, Ericsson, Schneider Electric, Itron, Verizon, and Microsoft.

5.1 Smart Streetlights Sub-Market

5.2 Smart Parking Systems Sub-Market

5.3 Smart Waste Management Systems Sub-Market

5.4 Environmental Monitoring Sensors Sub-Market

5.5 Public Transportation Tracking Devices Sub-Market

6. Healthcare IoT Market The healthcare IoT market focuses on the application of connected devices and technologies to improve patient care, monitoring, and health outcomes.

This market includes remote patient monitoring devices, connected medical equipment, telehealth and telemedicine devices, and medication management devices.

The global healthcare IoT market is projected to reach $187.6 billion by 2025, growing at a CAGR of 20.8% from 2020 to 2025.

Key players in this market include Medtronic, Philips, GE Healthcare, Abbott, Boston Scientific, Siemens Healthineers, Cerner, Cisco, IBM, and Qualcomm.

6.1 Remote Patient Monitoring Devices Sub-Market

6.2 Connected Medical Equipment Sub-Market

6.3 Telehealth and Telemedicine Devices Sub-Market

6.4 Medication Management Devices Sub-Market

7. Agricultural IoT Market The agricultural IoT market involves the use of connected devices and technologies to optimize farming practices, increase productivity, and improve resource management.

This market includes smart irrigation systems, livestock monitoring devices, precision farming sensors, and agricultural drones.

The global agricultural IoT market is expected to reach $32.75 billion by 2027, with a CAGR of 15.2% from 2020 to 2027.

Major vendors in this market include John Deere, Trimble, DeLaval, Raven Industries, AGCO, Topcon Positioning Systems, Semios, Antelliq (Merck Animal Health), Smartcultiva, and CropX.

7.1 Smart Irrigation Systems Sub-Market

7.2 Livestock Monitoring Devices Sub-Market

7.3 Precision Farming Sensors Sub-Market

7.4 Agricultural Drones Sub-Market

8. Retail and Hospitality IoT Market The retail and hospitality IoT market focuses on the application of connected devices and technologies to enhance customer experiences, improve operational efficiency, and drive sales.

This market includes smart shelves and inventory tracking devices, automated checkout systems, beacons and location-based services, and smart hotel room devices.

The global retail IoT market is projected to reach $94.44 billion by 2025, growing at a CAGR of 21.5% from 2020 to 2025.

Key players in this market include Intel, IBM, Cisco, SAP, PTC, Zebra Technologies, Honeywell, Impinj, Sensormatic (Johnson Controls), and Aruba (HPE).

8.1 Smart Shelves and Inventory Tracking Devices Sub-Market

8.2 Automated Checkout Systems Sub-Market

8.3 Beacons and Location-Based Services Sub-Market

8.4 Smart Hotel Room Devices Sub-Market

9. Smart Energy Devices Market The smart energy devices market involves the deployment of connected technologies and devices to optimize energy generation, distribution, and consumption.

This market includes smart meters, smart grid components, renewable energy monitoring systems, and energy storage devices.

The global smart energy market is expected to reach $253.1 billion by 2027, with a CAGR of 12.4% from 2020 to 2027.

Leading vendors in this market include Itron, Landis+Gyr, Siemens, Schneider Electric, GE, ABB, Honeywell, Eaton, Kamstrup, and Sensus (Xylem).

9.1 Smart Meters Sub-Market

9.2 Smart Grid Components Sub-Market

9.3 Renewable Energy Monitoring Systems Sub-Market

9.4 Energy Storage Devices Sub-Market

10. Drones and Robotics Market The drones and robotics market encompasses the use of unmanned aerial vehicles (UAVs) and robotic systems for various applications across industries.

This market includes consumer drones, industrial drones, service robots, and collaborative robots (cobots).

The global drones and robotics market is projected to reach $241.13 billion by 2026, growing at a CAGR of 20.3% from 2021 to 2026.

Key players in this market include DJI, Parrot, 3D Robotics, AeroVironment, Yuneec, Kespry, Autel Robotics, ABB, KUKA, FANUC, Yaskawa Electric, and Universal Robots.

10.1 Consumer Drones Sub-Market

10.2 Industrial Drones Sub-Market

10.3 Service Robots Sub-Market

10.4 Collaborative Robots (Cobots) Sub-Market

This comprehensive overview of the Internet of Things (IoT) markets highlights the diverse range of connected devices and technologies being deployed across various sectors. As these markets continue to grow and evolve, they are expected to transform industries, enhance efficiency, and create new opportunities for innovation and growth.

———————-

Market Sizes

———————-

Here are the credible market number estimates provided in the document for the various IoT markets and submarkets:

Smart Home Devices Market

Global market expected to reach $135.3 billion by 2025, growing at a CAGR of 11.6% from 2020 to 2025.

Wearables Market

Global market projected to reach $116.88 billion by 2026, with a CAGR of 13.8% from 2021 to 2026.

Connected Vehicles Market

Global connected car market expected to reach $166.0 billion by 2025, with a CAGR of 17.1% from 2020 to 2025.

Industrial IoT (IIoT) Market

Global market projected to reach $263.4 billion by 2027, growing at a CAGR of 16.7% from 2020 to 2027.

Smart City Devices Market

Global market expected to reach $820.7 billion by 2025, with a CAGR of 14.8% from 2020 to 2025.

Healthcare IoT Market

Global market projected to reach $187.6 billion by 2025, growing at a CAGR of 20.8% from 2020 to 2025.

Agricultural IoT Market

Global market expected to reach $32.75 billion by 2027, with a CAGR of 15.2% from 2020 to 2027.

Retail and Hospitality IoT Market

Global retail IoT market projected to reach $94.44 billion by 2025, growing at a CAGR of 21.5% from 2020 to 2025.

Smart Energy Devices Market

Global market expected to reach $253.1 billion by 2027, with a CAGR of 12.4% from 2020 to 2027.

Drones and Robotics Market

Global market projected to reach $241.13 billion by 2026, growing at a CAGR of 20.3% from 2021 to 2026.

————

corresponding sub-markets:

1. Amazon - Smart Thermostats

2. Google - Smart Thermostats

3. Nest - Smart Thermostats

4. Ecobee - Smart Thermostats

5. Philips - Smart Lighting Systems

6. Samsung - Smart Lighting Systems, Smartwatches

7. August - Smart Locks and Security Systems

8. Ring - Smart Locks and Security Systems

9. Arlo - Smart Locks and Security Systems

10. Apple - Smartwatches

11. Fitbit - Smartwatches, Fitness Trackers

12. Garmin - Smartwatches, Fitness Trackers

13. Huawei - Smartwatches, Fitness Trackers

14. Xiaomi - Smartwatches, Fitness Trackers

15. Fossil - Smartwatches

16. Alphabet - Fitness Trackers, Smart Glasses

17. Medtronic - Medical Wearables, Remote Patient Monitoring Devices

18. Omron Healthcare - Medical Wearables

19. Bosch - Connected Car Platforms, Smart Manufacturing Equipment

20. Continental - Connected Car Platforms

21. HARMAN - In-Vehicle Infotainment Systems

22. Visteon - In-Vehicle Infotainment Systems

23. Aptiv - In-Vehicle Infotainment Systems

24. Airbiquity - Connected Car Platforms

25. Nvidia - Autonomous Vehicles

26. Autoliv - Autonomous Vehicles

27. Siemens - Smart Manufacturing Equipment, Smart Grid Components, Siemens Healthineers

28. GE - Smart Manufacturing Equipment, Smart Grid Components

29. Rockwell Automation - Smart Manufacturing Equipment

30. Honeywell - Smart Manufacturing Equipment, Smart Grid Components

31. ABB - Smart Manufacturing Equipment, Smart Grid Components

32. Schneider Electric - Smart Manufacturing Equipment, Smart Grid Components

33. Emerson - Smart Manufacturing Equipment

34. Cisco - Healthcare IoT Market

35. IBM - Healthcare IoT Market, Retail IoT Market

36. PTC - Predictive Maintenance Systems

37. Cerner - Connected Medical Equipment

38. Abbott - Remote Patient Monitoring Devices

39. Boston Scientific - Remote Patient Monitoring Devices

40. John Deere - Smart Irrigation Systems

41. Trimble - Smart Irrigation Systems

42. DeLaval - Livestock Monitoring Devices

43. Antelliq (Merck Animal Health) - Livestock Monitoring Devices

44. Raven Industries - Precision Farming Sensors

45. AGCO - Precision Farming Sensors

46. Topcon Positioning Systems - Precision Farming Sensors

47. Semios - Precision Farming Sensors

48. Smartcultiva - Precision Farming Sensors

49. CropX - Smart Irrigation Systems

50. Intel - Smart Shelves and Inventory Tracking Devices

51. Zebra Technologies - Smart Shelves and Inventory Tracking Devices

52. Impinj - Smart Shelves and Inventory Tracking Devices

53. Sensormatic (Johnson Controls) - Smart Shelves and Inventory Tracking Devices

54. Itron - Smart Meters

55. Landis+Gyr - Smart Meters

56. Kamstrup - Smart Meters

57. Sensus (Xylem) - Smart Meters

58. Eaton - Smart Grid Components

59. DJI - Consumer Drones

60. Parrot - Consumer Drones

61. 3D Robotics - Consumer Drones

62. AeroVironment - Consumer Drones

63. Yuneec - Consumer Drones

64. Kespry - Consumer Drones

65. Autel Robotics - Consumer Drones

66. ABB - Service Robots

67. KUKA - Service Robots

68. FANUC - Service Robots

69. Yaskawa Electric - Service Robots

70. Universal Robots - Collaborative Robots (Cobots)

71. Ecobee - Smart Thermostats

72. Wyze - Smart Home Devices

73. TP-Link - Smart Home Devices

74. Belkin - Smart Home Devices

75. Oura - Smart Rings/Wearables

76. Whoop - Fitness Wearables

77. Tesla - Connected Vehicles

78. Ford - Connected Vehicles

79. General Motors - Connected Vehicles

80. Toyota - Connected Vehicles

81. Volkswagen - Connected Vehicles

82. Mitsubishi Electric - Industrial Automation

83. Hitachi - Industrial IoT

84. Fujitsu - Industrial IoT

85. Advantech - Industrial IoT

86. Verizon - Smart City Solutions

87. AT&T - Smart City Solutions

88. Telus - Smart City Solutions

89. CurrentNext - Smart Streetlights

90. Philips Lighting - Smart Streetlights

91. iRhythm - Remote Cardiac Monitoring

92. AliveCor - Remote Cardiac Monitoring

93. BioTelemetry - Remote Cardiac Monitoring

94. John Deere - Agricultural Drones

95. DroneDeploy - Agricultural Drones

96. Pix4D - Agricultural Drones

97. Slalom - Retail IoT Solutions

98. Diebold Nixdorf - Retail IoT Solutions

99. Socios - Smart Hotel Room Devices

100. WiTricity - Wireless Charging for EVs

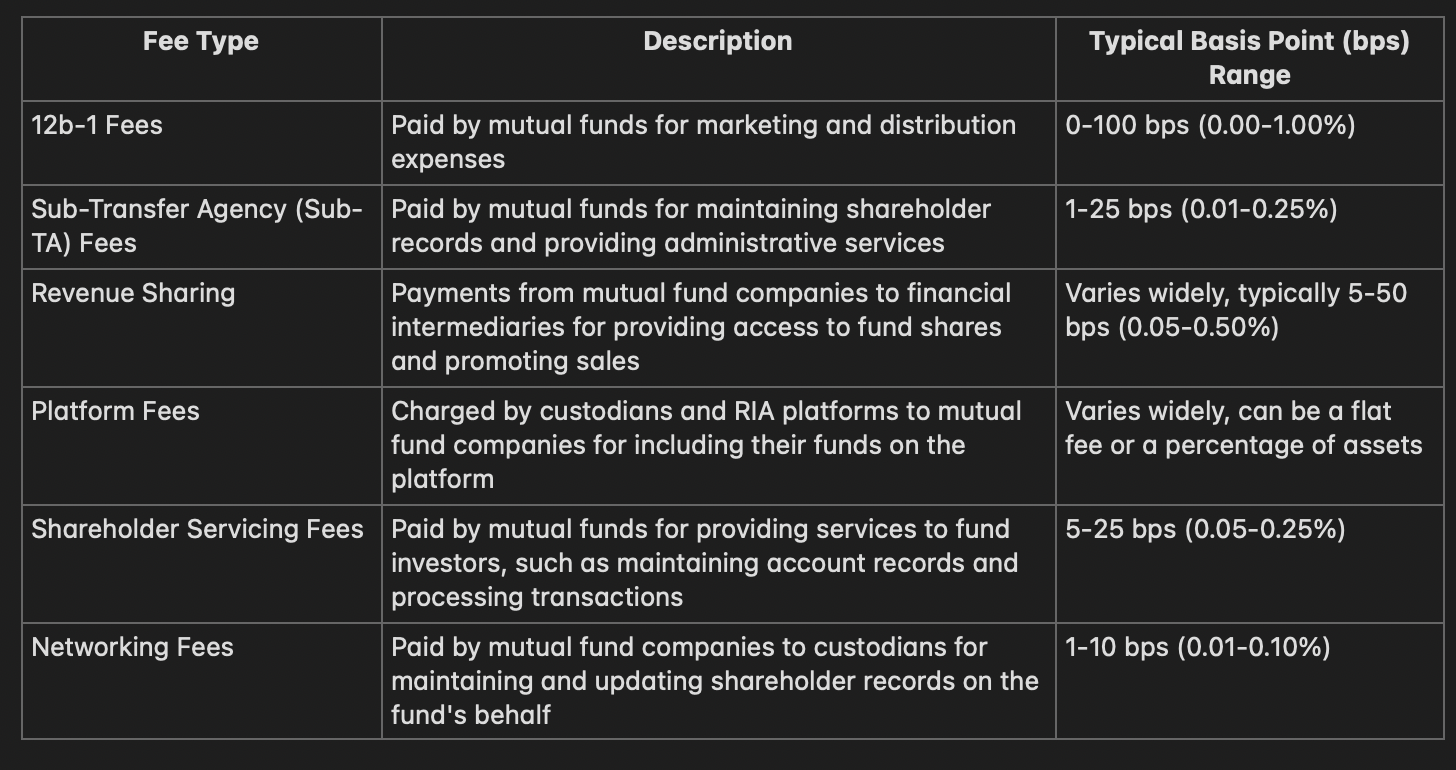

Company Report: Verisign

Recommended soundtrack: Sympathy For The Devil, Rolling Stones

———————

R&D Themes

Based on analyzing Verisign's research and development time several key R&D themes emerge:

1. Domain Name System (DNS) Enhancements

Definition: Improvements to DNS security, performance, and functionality

Unique Value: Enables a more secure, efficient and feature-rich domain name system

Examples: DNSSEC signing, DNS traffic analysis, smart DNS resolution

2. Registry & Registrar Systems

Definition: Shared Registration System (SRS) and Extensible Provisioning Protocol (EPP) enhancements

Unique Value: Streamlines domain registration processes and enhances security of domain ownership changes

Examples: Bulk domain management, secure multi-factor authentication, registry-registrar communication

3. Internet Security & Anti-Abuse

Definition: Systems to protect internet infrastructure and users from attacks and malicious domains

Unique Value: Protects the stability and integrity of internet services and enhances user trust

Examples: DDoS detection/mitigation, malware analysis, domain reputation systems

4. Internet of Things (IoT) Enablement

Definition: Leveraging DNS and PKI to enable discovery, security and data exchange for IoT devices

Unique Value: Allows IoT devices to be securely registered, authenticated and communicated with

Examples: Automated secure provisioning of IoT devices with unique identities and certificates

5. New Top-Level Domain (TLD) Services

Definition: Consulting and back-end registry services to support the expansion of the domain name space

Unique Value: Provides infrastructure to rapidly and securely onboard new TLDs

Examples: Whois, DNS, rights protection and other services tailored for new TLD operators

Unique Interactive Effects:

1. Secure, automated provisioning and lifecycle management of domain names and IoT devices

2. Real-time threat intelligence from DNS traffic analysis fed into automated internet security systems

3. Intelligent DNS resolution based on client and network context for an optimized, localized experience

Product Observation

Verisign's R&D efforts are delivering significant value by evolving core internet systems to be more secure, performant and adaptive to the needs of modern users and applications. By enhancing foundational technologies like DNS and PKI, Verisign is enabling a new era of secure, trusted internet services.

A major thrust is evolving the Domain Name System to be more resilient to attack, optimized for performance, and extensible with new capabilities. This provides a rock-solid foundation for the next generation of online applications. In parallel, Verisign is streamlining domain management, fighting internet abuse to preserve trust, enabling the secure growth of the IoT, and powering the expansion of domain names through new TLD services.

Across these initiatives, Verisign is leveraging its deep expertise and global infrastructure in synergistic ways. For example, integrating domain name security intelligence into IoT device authentication, or using DNS traffic analysis to inform both network optimization and threat mitigation. The end result is greater than the sum of its parts: A unified platform for secure, trusted, high-performance internet services that continues to scale as the internet grows.

Bottom Line Verisign’s Unique Value:

1) Enables a more secure, efficient and feature-rich domain name system

2) Unique Value: Streamlines domain registration processes and enhances security of domain ownership changes

3) Provides infrastructure to rapidly and securely onboard new TLDs

4) Secure, automated provisioning and lifecycle management of domain names and IoT devices

5) Real-time threat intelligence from DNS traffic analysis fed into automated internet security systems

6) Intelligent DNS resolution based on client and network context for an optimized, localized experience

7) Protects the stability and integrity of internet services and enhances user trust

8) Provides infrastructure to rapidly and securely onboard new TLDs

9) Allows IoT devices to be securely registered, authenticated and communicated with

Company Report: Qualcomm

Recommend soundtrack: Tell You Like This, Show Tha Product

Qualcomm is a leading semiconductor and telecommunications company that has a diverse portfolio of products and services across various markets. The company's success can be attributed to its strong focus on research and development, which has led to groundbreaking innovations in multiple domains.

Mobile Chipsets and Processors

Qualcomm's Snapdragon line of mobile chipsets and processors is widely used in smartphones, tablets, and other mobile devices. These chipsets integrate cutting-edge technologies like 5G connectivity, artificial intelligence (AI) processing capabilities, and advanced multimedia features. Qualcomm's research and development efforts in mobile computing have resulted in highly efficient and powerful chipsets that enable seamless mobile experiences for consumers.

Internet of Things (IoT) Solutions

In the rapidly growing IoT market, Qualcomm offers a range of chipsets and solutions for smart home devices, wearables, industrial applications, and connected vehicles. The company's research and development initiatives in this area have focused on developing energy-efficient and secure chipsets that facilitate seamless communication and data processing within IoT ecosystems.

Automotive Solutions

Qualcomm's automotive solutions encompass chipsets and technologies for connected cars, infotainment systems, and advanced driver assistance systems (ADAS). The company's research and development efforts in this domain have led to innovations that enable features like navigation, entertainment, and vehicle-to-vehicle communication, enhancing the overall driving experience.

Wireless Communications and Licensing

Qualcomm has a strong presence in the wireless communications industry, with research and development initiatives focused on developing cutting-edge technologies for 3G, 4G, and 5G networks. The company's licensing business involves licensing its research and development findings and technologies to other companies, contributing to the advancement of wireless communication standards worldwide.

Artificial Intelligence (AI) and Machine Learning

Qualcomm has made significant research and development investments in the field of AI and machine learning. The company's AI engine and processors are integrated into its mobile and IoT chipsets, enabling efficient on-device AI processing. Qualcomm's research and development in this area has led to innovations that enhance the performance and power efficiency of AI applications across various domains.

In addition to these core product lines, Qualcomm continues to explore and invest in research and development opportunities in emerging technologies, such as extended reality (XR), autonomous driving, and quantum computing. The company's commitment to research and development has been instrumental in driving innovation and maintaining its competitive edge in the rapidly evolving technology landscape.

————————

Markets

Qualcomm operates in several large and rapidly growing markets, including:

Mobile

The global smartphone market was valued at around $637 billion in 2022 and is projected to reach $847 billion by 2027.

Qualcomm is a leading supplier of mobile processors and modems for smartphones and other mobile devices.

The company held around 33% revenue share in the mobile AP/modem market in 2021 .

Internet of Things (IoT)

The global IoT market size was valued at $388.3 billion in 2022 and is expected to grow to $1.4 trillion by 2030 (Source: Grand View Research).

Qualcomm's processors and connectivity solutions are widely used in IoT devices across industries like smart home, wearables, industrial IoT, and more.

Automotive

The global automotive semiconductor market was valued at $51.8 billion in 2022 and is projected to reach $100.6 billion by 2030.

Qualcomm supplies processors, modems, and AI solutions for advanced automotive systems like infotainment, telematics, ADAS, and autonomous driving.

The company is a leader in automotive telematics and connectivity solutions.

AI/Machine Learning

The global AI chip market size was valued at $8.6 billion in 2022 and is expected to reach $191.8 billion by 2030.

Qualcomm's AI Engine and AI processors enable on-device AI capabilities for edge computing in IoT, mobile, and automotive applications.

Overall, Qualcomm is well-positioned in multiple large and fast-growing markets driven by trends like 5G connectivity, IoT proliferation, increasing adoption of AI/ML, and the shift toward autonomous and connected vehicles. The company's diverse product portfolio allows it to tap into these opportunities across different sectors.

Market Report: The Integration Of Piezoelectric Actuators and AI Chips

Recommended soundtrack: Chaise Leg, Wet Leg

Executive Summary